lffinance.ru Market

Market

Evofem Stock Price

Previous close. The last closing price. $ ; Day range. The range between the high and low prices over the past day. $ - $ ; Year range. The range. Evofem Biosciences Inc. ; Open. ; High. ; 52wk High. ; Volume. k ; Beta. Discover real-time Evofem Biosciences Inc. (EVFM) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Stock price history for Evofem Biosciences (EVFM). Highest end of day price: $, USD on Lowest end of day price: $ USD on See the latest Evofem Biosciences Inc stock price (EVFM:PINX), related news, valuation, dividends and more to help you make your investing decisions. Evofem Biosciences Inc price ; Market Cap. K ; Volume (3M). K ; Price-Earnings Ratio. - ; Revenue. M. What was Evofem Biosciences's price range in the past 12 months? Evofem Biosciences lowest stock price was and its highest was $ in the past Evofem Biosciences Inc EVFM. Morningstar Rating. Performance; Quote; Analysis price; a 1-star stock isn't. If our base-case assumptions are true the. The Evofem Biosciences stock price fell by % on the last day (Friday, 23rd Aug ) from $ to $ During the last trading day the stock. Previous close. The last closing price. $ ; Day range. The range between the high and low prices over the past day. $ - $ ; Year range. The range. Evofem Biosciences Inc. ; Open. ; High. ; 52wk High. ; Volume. k ; Beta. Discover real-time Evofem Biosciences Inc. (EVFM) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Stock price history for Evofem Biosciences (EVFM). Highest end of day price: $, USD on Lowest end of day price: $ USD on See the latest Evofem Biosciences Inc stock price (EVFM:PINX), related news, valuation, dividends and more to help you make your investing decisions. Evofem Biosciences Inc price ; Market Cap. K ; Volume (3M). K ; Price-Earnings Ratio. - ; Revenue. M. What was Evofem Biosciences's price range in the past 12 months? Evofem Biosciences lowest stock price was and its highest was $ in the past Evofem Biosciences Inc EVFM. Morningstar Rating. Performance; Quote; Analysis price; a 1-star stock isn't. If our base-case assumptions are true the. The Evofem Biosciences stock price fell by % on the last day (Friday, 23rd Aug ) from $ to $ During the last trading day the stock.

Volatile ride for Evofem Biosciences stock price on Friday moving between $ and $ (Updated on Aug 23, ) · EVFM Signals & Forecast · Support, Risk. Stock price for similar companies or competitors ; Evofem Biosciences Logo · Onconova Therapeutics. ONTX. $, % ; Evofem Biosciences Logo · OPKO Health. Evofem Biosciences Inc. ; Open. ; High. ; 52wk High. ; Volume. k ; Beta. Stock price history for Evofem Biosciences (EVFM). Highest end of day price: $, USD on Lowest end of day price: $ USD on Evofem Biosciences Inc EVFM:OTCQB · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date09/11/23 · 52 Week Low. EVFM Evofem Biosciences · High. · Low. · Volume. K · Open. · Pre Close. · Turnover. K · Turnover Ratio. % · P/E (Static). Track Evofem Biosciences Inc (EVFM) Stock Price, Quote, latest community messages, chart, news and other stock related information. Projected Stock Price. $ ↑1,,%. Estimated share price by October 5, ; Projected Revenue. 25 MM ↑%. Estimated quarterly revenue by. The latest Evofem Biosciences stock prices, stock quotes, news, and EVFM history to help you invest and trade smarter. View the latest Evofem Biosciences Inc. (EVFM) stock price, news, historical charts, analyst ratings and financial information from WSJ. Evofem Biosciences Inc. ; Median, $ ; Low, $ ; Average, $ ; Current Price, $ ; Current, -$ Discover historical prices for EVFM stock on Yahoo Finance. View daily, weekly or monthly format back to when Evofem Biosciences, Inc. stock was issued. About Evofem Biosciences Inc (EVFM) ; Yesterday's range. $ - $ ; Debt / equity. — ; 52 week range. $ - $ ; 5 year debt / equity. x ; Beta (LTM). Evofem Biosciences Inc stocks price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. Wainwright reiterated a Buy rating on Evofem Biosciences, with a price target of $ The company's shares closed last Friday at $, close to its week. EVFM / Evofem Biosciences, Inc. (OTCPK) - Forecast, Price Target, Estimates, Predictions ; Projected Stock Price. $ ↑1,,%. Estimated share price. Evofem Biosciences, Inc. (EVFM.): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Evofem Biosciences, Inc. | OTC Markets. The Evofem Biosciences, Inc. stock price is currently $ with a total market cap valuation of $ M (M shares outstanding). The Evofem Biosciences. Evofem Biosciences Inc. (EVFM) Stock Performance ; Evofem Biosciences (EVFM). --, -- ; BSE Sensex. , ; S&P Small-Cap · , EVFM Evofem Biosciences · High. · Low. · Volume. K · Open. · Pre Close. · Turnover. K · Turnover Ratio. % · P/E (Static).

How Do Student Loans Affect Buying A House

Can you use a student loan to apply for a mortgage? Student loans cannot be used as a sole source of income for mortgage purposes. If the funds aren't taxable. Student loan payments can make it harder to find room in your budget for house payments. Mortgage lenders might not like seeing the debt you are carrying. Highlights: Substantial student loan debt can affect your ability to make large purchases and take on other debts, such as a mortgage. Yes. The bank or mortgage company will want to see that your income can cover payments for both the student loans and your mortgage (and any. Can I Use My Student Loan as Income Towards Mortgage Affordability? Some students use a student loan towards their deposit - but there are ramifications to. You may think you can't get a mortgage with a big student loan, but that's not the case. Getting a mortgage with a student loan is both possible and common. “Defaulting on a federal student loan can cause your credit score to drop by to points or more, plunging it into the subprime range, which makes you. Student loans don't affect 'creditworthiness' One of the biggest factors determining whether or not you'll be accepted for a mortgage is how lenders perceive. You can still qualify for a mortgage regardless of your student debt. The key is being on time with your payments and ensuring you have enough income to offset. Can you use a student loan to apply for a mortgage? Student loans cannot be used as a sole source of income for mortgage purposes. If the funds aren't taxable. Student loan payments can make it harder to find room in your budget for house payments. Mortgage lenders might not like seeing the debt you are carrying. Highlights: Substantial student loan debt can affect your ability to make large purchases and take on other debts, such as a mortgage. Yes. The bank or mortgage company will want to see that your income can cover payments for both the student loans and your mortgage (and any. Can I Use My Student Loan as Income Towards Mortgage Affordability? Some students use a student loan towards their deposit - but there are ramifications to. You may think you can't get a mortgage with a big student loan, but that's not the case. Getting a mortgage with a student loan is both possible and common. “Defaulting on a federal student loan can cause your credit score to drop by to points or more, plunging it into the subprime range, which makes you. Student loans don't affect 'creditworthiness' One of the biggest factors determining whether or not you'll be accepted for a mortgage is how lenders perceive. You can still qualify for a mortgage regardless of your student debt. The key is being on time with your payments and ensuring you have enough income to offset.

Student loan debt can discourage potential homebuyers in a variety of ways. Between raising your debt-to-income ratio and making it harder to save for a down. Student Loans Affect Your FICO Score. Having a stellar FICO score increases your chance of getting mortgage pre-approval, plus it helps you secure a loan with a. For many recent graduates, your student loan is the #1 factor in determining your credit rating. If you stay on track, your credit rating goes up. Miss payments. The findings show that student debt does hold back home buyers. While the themes are consistent based on past research, the current report expands the knowledge. Delinquent federal student loan debt can lead to mortgage denial. Some government-backed loan programs require a Credit Alert Verification Reporting System . Housing: If you are trying to move out on your own and rent an apartment, keep in mind that your student loans and your repayment history will impact. The biggest impact that student loans are making on mortgage lending is that they must be included in a buyers monthly debts. Buying a house with student loan debt is very much possible, as long as you're willing to put in the hard financial work. With careful budgeting, lots of. Yes - absolutely. The amounts owed are figured into the qualification process for the home buyer who has the student loan. · The problem is there. So don't be embarrassed about the size of your Student Loan as this does not come into the bank's affordability equation. The only figure banks are interested. Do student loans affect getting a mortgage? You'll have a more difficult time obtaining a home loan when you have student loans. For one thing, that monthly. Student loan debt can discourage potential homebuyers in a variety of ways. Between raising your debt-to-income ratio and making it harder to save for a down. Yes, your student loan can affect you getting a mortgage. However, student loan debt alone will not stop you from getting a mortgage. Most lenders will consider. While getting a mortgage with student loan debt is quite possible, it will affect your mortgage affordability, which is how much you can borrow based on your. Buying a house with student loans is difficult for obvious reason. Adding another debt to your budget reduces your monthly cash flow. Student Loans Affect Your FICO Score. Having a stellar FICO score increases your chance of getting mortgage pre-approval, plus it helps you secure a loan with a. To determine whether you qualify for a mortgage, lenders review how much of your monthly income is devoted to debt — including student loans, car loans and. I am a real estate professional. What does this mean for my business? NAR research indicates that student debt negatively impacts the ability of potential. Yes, your student loan can affect you getting a mortgage. However, student loan debt alone will not stop you from getting a mortgage. Most lenders will consider. Student Loans Affect Your FICO Score. Having a stellar FICO score increases your chance of getting mortgage pre-approval, plus it helps you secure a loan with a.

How Can I Get Rich Now

Getting rich usually isn't an immediate process; it's the result of dedicating saving, budgeting, and investing. The more you save now, the more you'll have. For the people who took that advice they're now earning essentially nothing on their savings that they thought would support them in retirement. If they hadn't. How to Get Rich · Start saving early. · Avoid unnecessary spending and debt. · Save 15% or more of every paycheck. · Increase the money that you earn. · Resist the. What it means: Your Rich Life doesn't have to wait until you're You can start living it now. Get specific. What could your “everyday” Rich Life look like? 1. Establish Financial Goals · 2. Destroy Your Debt · 3. Create a Cushion · 4. Start Investing Now · 5. Diversify Your Portfolio · 6. Boost Your Income · 7. Learn. Similar to budgeting, learning to invest can also help you become wealthy without necessarily having to work all year. But this doesn't mean you should jump. In , 84% of the richest people got rich by inheritance, extracting natural resources, or doing real estate deals. The Seven Best Ways to become Rich · 1. Start your own business and eventually sell it. · 2. Join a start-up and get stock. · 3. Exploit your skill as a self-. Learning how to become rich could mean being debt free, retiring early, paying off your house, not living paycheck to paycheck, growing a nest egg, or just. Getting rich usually isn't an immediate process; it's the result of dedicating saving, budgeting, and investing. The more you save now, the more you'll have. For the people who took that advice they're now earning essentially nothing on their savings that they thought would support them in retirement. If they hadn't. How to Get Rich · Start saving early. · Avoid unnecessary spending and debt. · Save 15% or more of every paycheck. · Increase the money that you earn. · Resist the. What it means: Your Rich Life doesn't have to wait until you're You can start living it now. Get specific. What could your “everyday” Rich Life look like? 1. Establish Financial Goals · 2. Destroy Your Debt · 3. Create a Cushion · 4. Start Investing Now · 5. Diversify Your Portfolio · 6. Boost Your Income · 7. Learn. Similar to budgeting, learning to invest can also help you become wealthy without necessarily having to work all year. But this doesn't mean you should jump. In , 84% of the richest people got rich by inheritance, extracting natural resources, or doing real estate deals. The Seven Best Ways to become Rich · 1. Start your own business and eventually sell it. · 2. Join a start-up and get stock. · 3. Exploit your skill as a self-. Learning how to become rich could mean being debt free, retiring early, paying off your house, not living paycheck to paycheck, growing a nest egg, or just.

How to Get Rich: With Kyleen McHenry, Ramit Sethi. Money holds power The Minimalists: Less Is Now. The Minimalists: Less Is Now. Watch options. 1. Start your own business and eventually sell it. This is the most effective and proven way to become rich. 5 years appreciation at 5% is where your future wealth lies. You don't need any of your own money to do this. You don't need to quit your job. Personal finance expert Ramit Sethi has been called a “wealth wizard” by Forbes and the “new guru on the block” by Fortune. Now he's updated and expanded his. Getting rich quickly is a goal many people share, but it's important to approach it with caution and realistic expectations. While there's no guaranteed way to. In my experience now, investing money wisely to earn money is the fastest way to acquire wealth, but assuming you have no money to start with, selling. To become wealthy, develop a phone addiction but focus on creating content rather than consuming it. The attention economy rewards creators. Your return on investment is unlimited when you invest in yourself. Tweet. Now, I don't necessarily mean go straight to college, go into debt by several $10, If you don't have any marketable skills, learn one. For example, one of the most desirable and useful skills in today's job market is knowing how to write. “We saved for retirement but have no money to spend NOW” (Part 1). Michelle is 42, Ryan is They've been married for 9 years and share three young. Join Now Sign In. How to Get Rich. | Maturity Rating:TV | 1 Season | Documentary. Money holds power over us — but it doesn't have to. Creating a budget and sticking to it is crucial if you want to know how to build wealth from nothing. Using that regular income source we just spoke of, now you. pages 5 hours Get Rich Now: Earn More Money, Faster and Easier than Ever Before By Brian Tracy 5/5 (1 rating) Switch to audiobook Read free for days. There are a very limited number of jobs that can make you rich, but everyone can start a business. Not many businesses succeed, but in capitalism owning equity. The advantage of creating wealth, as a way to get rich, is not just that it's more legitimate (many of the other methods are now illegal) but that it's more. I want to share with you my 11 principles to be rich and build a ton of wealth. Now I know what I'd be asking - IS THIS GUY RICH? And to that, I'd say that I'm. The advantage of creating wealth, as a way to get rich, is not just that it's more legitimate (many of the other methods are now illegal) but that it's more. The best way to get rich over the long term is to invest in real estate. Real estate is the best asset class to build wealth because it is tangible, generates. Start investing $ a month today. Allocate 80% to an S&P index fund and 20% to a U.S. Treasury bond fund. Assume a 6% average annual return. Listen to Ramit Sethi's I Will Teach You To Be Rich podcast with Ramit Sethi on Apple Podcasts now on Audible • Get my New York Times best-selling book • Get.

Best Pos Hardware For Retail

POS stands for point of sale. Epos Now's retail POS system is an all-in-one, hassle-free tool for running a retail business, large or small. It includes sales. New Hardware Installation and Deployment; Refurbished Hardware Options; Hybrid Hardware Solutions; Trade-Ins / Upgrades. Get Unmatched Support and Best-in-Class. Our Top Picks · KORONA POS – Best for Customer Training and Support · Lightspeed Retail – Best for Inventory Management · Square POS – Best Free POS System. A POS system is a combination of hardware (like a tablet, phone, or kiosk) and software (a digital program that tracks things like inventory and applies taxes). Why we like it: Lightspeed Retail POS stands out for its top-notch inventory management features, which include cataloging and tracking functions that are. Our Top Tested Picks · Square Point of Sale · Vend POS · Shopify POS · Bindo POS · Erply · Intuit QuickBooks Point of Sale · NCR Silver · ShopKeep. Best Retail POS System Shortlist · 1. KORONA POS — Best for real-time inventory tracking · 2. Stax Pay — Best omni-channel POS · 3. Payment Depot — Best for. Our curated collection brings you cutting-edge Point of Sale solutions tailored to meet the unique needs of your retail establishment. Top Providers for · 1. Lightspeed Retail POS · 2. Clover POS · 3. Square for Retail · 4. POS Nation for Retail · 5. Shopify POS · 6. Vend by Lightspeed · 7. POS stands for point of sale. Epos Now's retail POS system is an all-in-one, hassle-free tool for running a retail business, large or small. It includes sales. New Hardware Installation and Deployment; Refurbished Hardware Options; Hybrid Hardware Solutions; Trade-Ins / Upgrades. Get Unmatched Support and Best-in-Class. Our Top Picks · KORONA POS – Best for Customer Training and Support · Lightspeed Retail – Best for Inventory Management · Square POS – Best Free POS System. A POS system is a combination of hardware (like a tablet, phone, or kiosk) and software (a digital program that tracks things like inventory and applies taxes). Why we like it: Lightspeed Retail POS stands out for its top-notch inventory management features, which include cataloging and tracking functions that are. Our Top Tested Picks · Square Point of Sale · Vend POS · Shopify POS · Bindo POS · Erply · Intuit QuickBooks Point of Sale · NCR Silver · ShopKeep. Best Retail POS System Shortlist · 1. KORONA POS — Best for real-time inventory tracking · 2. Stax Pay — Best omni-channel POS · 3. Payment Depot — Best for. Our curated collection brings you cutting-edge Point of Sale solutions tailored to meet the unique needs of your retail establishment. Top Providers for · 1. Lightspeed Retail POS · 2. Clover POS · 3. Square for Retail · 4. POS Nation for Retail · 5. Shopify POS · 6. Vend by Lightspeed · 7.

Fourlane created this guide to help you learn what retail POS software is, why it's important, and what features to look for. One of the most important parts of a retail business is keeping customers happy. It's not enough to have great products – you also need to provide great service. Key Takeaways · Shopify POS: The best overall option. · Square POS: The best when it comes to free retail POS systems. · Loyverse POS: Ideal for small hardware. iPad point of sale hardware kit · LAN receipt printer · Cash drawer · Bluetooth scanner · Lightspeed iPad stand · Receipt paper. Our research found Clover is the best POS for retail stores, thanks to its impressive feature catalog, sleek hardware options, and intuitive interface. I recommend EkiKart POS. It's and easy, cost-effective solution with great features like EBT, Tobacco Scanning, Loyalty discounts, inventory. 1. Features · 2. Ease of Use · 3. Integration Capabilities · 4. Hardware · 5. Payment Processing ; Product Demos · User Reviews and Testimonials · Scalability · Cost. In this guide, we'll dive into the top 10 POS software solutions, focusing on their standout features to help you select the best one for your business. Top leaders in the category for POS Systems software are Square, Toast, Lightspeed. Here, you can view a full list of POS Systems tools in the market. faq icon. In an average POS system, you will find a computer, barcode scanner, thermal printer, cash drawer, payment terminal, and more. Top Retail POS Systems Filter + products based on features, industry, business size, and price. “Lightspeed Restaurant is a great POS. It's easy to use with a great interface and integrated accounting software. Pulse the help menu and videos are actually. Modern POS systems like Clover allow mobile sales, enable fast credit card processing and even facilitate loyalty programs. State of the art retail pos system for variety of brick and mortar stores. Acid pos connects online and in-store data seamlessly with smart checkout sales. A POS system is a combination of software and hardware that supports transactions between a customer and a merchant. A POS system can be used in conjunction. Square's point-of-sale system is our best overall pick. It's a good option for new stores because there aren't many upfront costs for small businesses. With. A retail point of sale (POS) system is a crucial tool that helps businesses handle sales transactions, inventory, customer data, and other essential operations. Clover is a complete cloud-based POS system that offers both hardware and software solutions. It's designed to help the retail industry, restaurants, service. Here's our ultimate guide to selecting a POS (point-of-sale) system, complete with the right questions to ask, and summaries of the top POS system providers. A POS system designed to help retail stores sell in-store and online seamlessly, with built-in tools for advanced inventory management, sales, and staffing.

Average Monthly House Insurance Payment

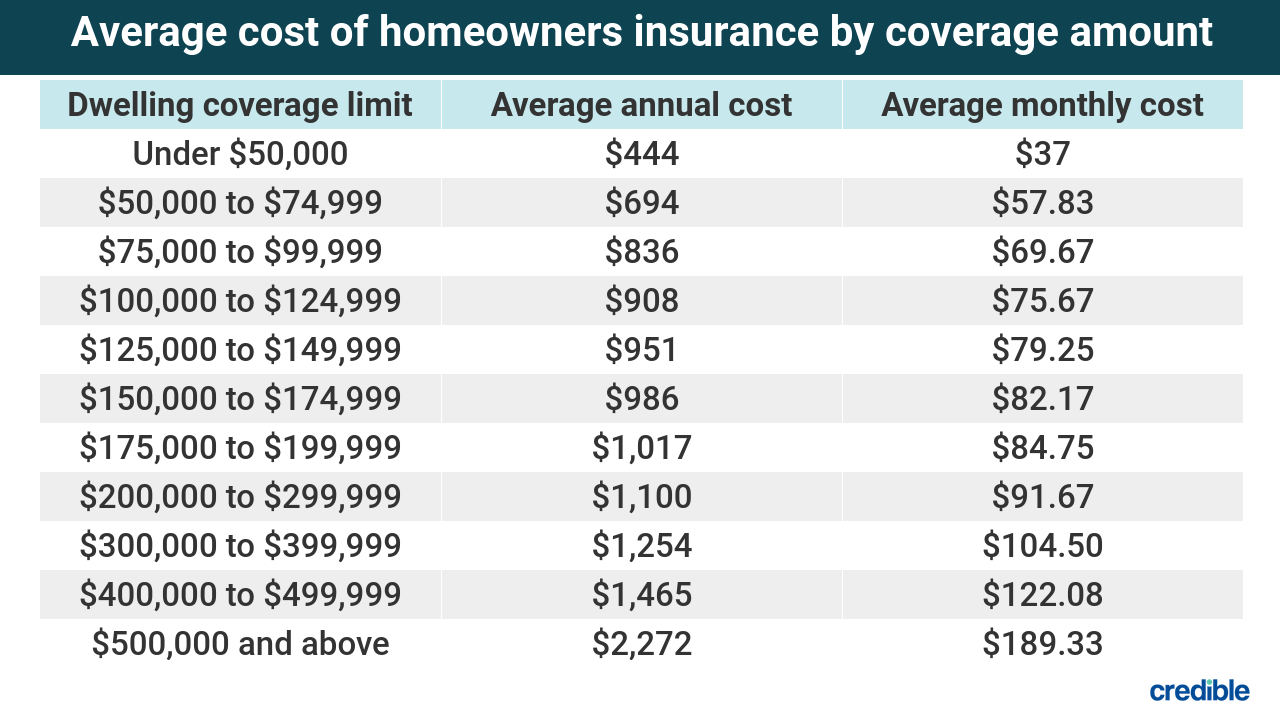

The national average homeowners insurance cost is $ and has been steadily increasing each year. ✓ Get details and learn how to keep costs down! While the amount you pay for PMI can vary, you can expect to pay approximately between $30 and $70 per month for every $, borrowed. PMI in action. A. The average annual cost of U.S. homeowners insurance is $2, — or $ per month, according to data from Quadrant Information Services. A one bedroom property costs £ on average to insure, but that goes up to £ for a four bedroom home, a 70% increase. Monthly vs. annual payments. It's. This guide lists annual rates for four typical homeowners policies. The companies listed are those with the largest market share in Oklahoma that responded to. The amount a buyer would pay for a home, including the land, regardless of how much it would cost to rebuild the home. What is replacement cost? Replacement. The national average cost of homeowners insurance is $2, per year for $, in dwelling coverage, but this cost will likely differ depending on which. The Average home insurance cost in Ottawa is around $1, per year or $ per month for your premium. Ottawa's home insurance rate is higher than the. “The First State” checks in at third for most expensive states to insure a home in, with average annual rates of $1, Budgeting for the monthly cost of. The national average homeowners insurance cost is $ and has been steadily increasing each year. ✓ Get details and learn how to keep costs down! While the amount you pay for PMI can vary, you can expect to pay approximately between $30 and $70 per month for every $, borrowed. PMI in action. A. The average annual cost of U.S. homeowners insurance is $2, — or $ per month, according to data from Quadrant Information Services. A one bedroom property costs £ on average to insure, but that goes up to £ for a four bedroom home, a 70% increase. Monthly vs. annual payments. It's. This guide lists annual rates for four typical homeowners policies. The companies listed are those with the largest market share in Oklahoma that responded to. The amount a buyer would pay for a home, including the land, regardless of how much it would cost to rebuild the home. What is replacement cost? Replacement. The national average cost of homeowners insurance is $2, per year for $, in dwelling coverage, but this cost will likely differ depending on which. The Average home insurance cost in Ottawa is around $1, per year or $ per month for your premium. Ottawa's home insurance rate is higher than the. “The First State” checks in at third for most expensive states to insure a home in, with average annual rates of $1, Budgeting for the monthly cost of.

This means that your monthly mortgage payment will also include an escrow payment to cover your property taxes and insurance premiums. Your lender will. Graph and download economic data for Producer Price Index by Industry: Premiums for Property and Casualty Insurance: Premiums for Homeowner's Insurance. pay for homeowner's coverage: · Type of Construction: Frame houses usually cost more to insure than brick houses. · Age of House: New homes may qualify for. A typical mortgage payment was under $1, per month in , according to CoreLogic. That was the average principal and interest (P&A) payment for a mortgage. The average cost of home insurance in the United States is $ per year, or $ per month. However, rates vary depending on the state where you live. The average cost of homeowners insurance in Miami is $8, per year for a $, home, $15, for a $, house, and $22, for a $, house. Keep. Nationally, homeowners pay an average premium of $ per year. How much does home insurance cost? Where you live can make a big difference in how much you will pay. In fact, the difference in annual costs between the most. Escrows are monthly installments to pay the annual bill when it is due. Your first 12 months of homeowner's covers now but your escrow covers. Remember that flood insurance and earthquake damage are not covered by a standard homeowners policy. If you buy a house in a flood-prone area, you'll have to. According to MoneyGeek's study, the average home insurance cost in the United States is $2, annually or $ monthly. The home's location, value and level of. I'm shocked to find that the lowest monthly premium I can find is over $ per month for such a small home. Is is normal for older houses to have way higher. Tenant insurance, also called renter's insurance, is usually the cheapest premium. It can be as low as $20/month. Homeowners insurance for a condo is not very. You will usually pay a deposit upfront (around % of your annual cost, depending on the provider), followed by 10 or 11 monthly payments. /of Average Monthly Payment$/mo. Get Quote. 4. Capital Insurance Group. MoneyGeek Score. /of Average Monthly Payment$/mo. While insuring your home is required when you purchase your property, it can be helpful to know how its cost is calculated. In general, most insurance for homes. According to the Insurance Information Institute (III), the average American homeowner pays just under $1, per year for a home insurance premium. However. Your mortgage company calculates your insurance and property taxes for the year · This is then divided by 12 and added to your monthly mortgage payments · When. What is the average cost of home insurance in Calgary? · The monthly average for Calgary home insurance is $ · The monthly range for Calgary home insurance is. If you're in the early stages of home buying, you can ask your real estate agent to ask the seller what they pay for their homeowners insurance to get an idea.

Fixed Accumulation Annuity

Both certificates of deposit (CDs) and fixed deferred annuities can be used to accumulate wealth. However, there are many differences between them. Nassau Bonus Annuity PlusSM is a single premium accumulation-focused fixed indexed annuity. Nassau Bonus Annuity Plus helps increase retirement savings with. A fixed annuity is a special kind of investment option, backed by an insurance company, that provides a guaranteed stream of income after a certain period of. How it works · Purchase early in life as a strategy to accumulate more value. · Transfer existing assets or start fresh. · Determine which type of annuity payout. During the accumulation phase, you make one single payment or multiple scheduled payments over a period of time in exchange for either a fixed or variable rate. The total current value of a fixed annuity which includes all of the premium payments made plus accumulated interest earnings to date. During the accumulation period of a fixed deferred annuity, your money, less any applicable charges, earns interest at rates set by the insurance company or in. When you buy a ForeAccumulation fixed index annuity, you're not investing in the stock market. Instead, your growth potential is linked to the performance of an. A fixed annuity is a type of insurance product that guarantees a fixed interest rate over a set period of time. Both certificates of deposit (CDs) and fixed deferred annuities can be used to accumulate wealth. However, there are many differences between them. Nassau Bonus Annuity PlusSM is a single premium accumulation-focused fixed indexed annuity. Nassau Bonus Annuity Plus helps increase retirement savings with. A fixed annuity is a special kind of investment option, backed by an insurance company, that provides a guaranteed stream of income after a certain period of. How it works · Purchase early in life as a strategy to accumulate more value. · Transfer existing assets or start fresh. · Determine which type of annuity payout. During the accumulation phase, you make one single payment or multiple scheduled payments over a period of time in exchange for either a fixed or variable rate. The total current value of a fixed annuity which includes all of the premium payments made plus accumulated interest earnings to date. During the accumulation period of a fixed deferred annuity, your money, less any applicable charges, earns interest at rates set by the insurance company or in. When you buy a ForeAccumulation fixed index annuity, you're not investing in the stock market. Instead, your growth potential is linked to the performance of an. A fixed annuity is a type of insurance product that guarantees a fixed interest rate over a set period of time.

Fixed-rate deferred annuities are annuity contracts that offer you a guaranteed fixed rate of interest over a specified period that you select. This period is. In a fixed annuity, the insurance company guarantees the principal and a minimum rate of interest. In other words, as long as the insurance company is. Annuities are insurance contracts that guarantee a fixed or variable payment to the annuitant (the investor) at some future time. Various Types of Annuities. Fixed annuity – This type of annuity accumulates interest on the funds deposited into the annuity on a fixed rate basis. Every. A fixed deferred annuity could be right for you. It gives you the security of a fixed guaranteed 1 interest rate while the interest you earn is tax-deferred. Classifying annuities · Nature of the underlying investment – fixed or variable · Primary purpose – accumulation or pay-out (deferred or immediate) · Nature of. During this period of time, your annuity earns interest. If you buy a fixed annuity, you'll earn a guaranteed minimum rate of interest over the term that you. Retirement savings: check. Fixed and variable deferred annuities, also known as accumulation annuities, can help you retire worry free by letting you save. A fixed equity indexed annuity is an accumulation annuity that credits excess interest in accordance with an external market index, such as the Standard &. The money in your annuity earns a guaranteed fixed interest rate. Plus, your money accumulates tax deferred, which means you don't pay income taxes on earnings. Fixed indexed annuities are designed to meet long-term needs for retirement income. They provide guarantees against the loss of principal and credited interest. MassMutual deferred fixed annuities can provide future guaranteed income that starts at a time you choose and continues for as long as you live. Allianz Accumulation Advantage is designed to emphasize accumulating for retirement. Because it's a fixed index annuity (FIA) it offers tax-deferred growth. If you choose Life Only, the company pays income for your lifetime. Life Annuity with Period Certain pays income for as long as you live and guarantees to make. With fixed annuities, the company bears the investment risk. During the accumulation period of a fixed deferred annuity, premiums (less any applicable. payments to you. • They offer a basic death benefit. If you die during the accumulation period, a deferred annuity with a basic death benefit. The different types of annuities—fixed, variable and indexed—come with different risks and potential rewards. Take time to learn the differences and compare. In a fixed annuity, your money — minus any applicable charges — earns interest at rates set by the insurer. The rate is specified in the annuity contract. The premiums paid and the interest credited to the premiums goes into a fund called an accumulation fund. There may be a minimum guaranteed interest rate at. Fixed annuities, more specifically, can provide you with some security, as they offer investors a guaranteed rate of interest. Money is accumulated either in a.

Where To Invest 5000 Dollars Right Now

Now, once you have paid off those credit cards and begun to set aside some money to save and invest, what are your choices? Page 10 | SAVING AND INVESTING. Amount of money that you have available to invest initially. Step 2 Planning for the future starts right now! Free Financial Planning Tools. 1. Invest in Government Bonds, Corporate Bonds, and Certificates of Deposit (CD's). (Low risk level) · 2. Invest in commodities (gold, silver. 5, tons/year). See exactly How our technology works by downloading our Right now, batteries are the bottleneck to store renewable solar and wind. and that has brought me now over like $22, if you're not interested in any of that kind of stuff, then you can put your money into stocks. specifically. You've probably heard that cash is king right now. But where can you stash your cash, earn a great rate, and avoid early withdrawal penalties if you want to. You have more options for mutual funds, individual company shares, index funds, IRAs, and for investing in real estate. While $5, isn't enough to purchase. We spoke to six experts about where they'd invest $1 million right now. Ideas include municipal bonds, European and Japanese equities, and dividend-paying US. How to invest $1, right now — wherever you are on your financial journey · 1. Build an emergency fund · 2. Pay down debt · 3. Put it in a retirement plan · 4. Now, once you have paid off those credit cards and begun to set aside some money to save and invest, what are your choices? Page 10 | SAVING AND INVESTING. Amount of money that you have available to invest initially. Step 2 Planning for the future starts right now! Free Financial Planning Tools. 1. Invest in Government Bonds, Corporate Bonds, and Certificates of Deposit (CD's). (Low risk level) · 2. Invest in commodities (gold, silver. 5, tons/year). See exactly How our technology works by downloading our Right now, batteries are the bottleneck to store renewable solar and wind. and that has brought me now over like $22, if you're not interested in any of that kind of stuff, then you can put your money into stocks. specifically. You've probably heard that cash is king right now. But where can you stash your cash, earn a great rate, and avoid early withdrawal penalties if you want to. You have more options for mutual funds, individual company shares, index funds, IRAs, and for investing in real estate. While $5, isn't enough to purchase. We spoke to six experts about where they'd invest $1 million right now. Ideas include municipal bonds, European and Japanese equities, and dividend-paying US. How to invest $1, right now — wherever you are on your financial journey · 1. Build an emergency fund · 2. Pay down debt · 3. Put it in a retirement plan · 4.

Customers must open and fund a new J.P. Morgan Self-Directed Investing account with new money of $5, or more by moving cash, transferring securities, or. “Few books around can teach people more about the investment universe.” — Inc Magazine From Nancy Dunnan, one of the nation's most respected financial. 5, tons/year). See exactly How our technology works by downloading our Right now, batteries are the bottleneck to store renewable solar and wind. Index funds: This asset is a portfolio of stocks or bonds that tracks a market index. It tends to have lower expenses and fees when compared with actively. Invest in High-Quality Dividend Stocks. This is one of the most popular answers to the question of what to invest dollars in. This amount. Accounts and Investment Types · Cash account. Suitable for trading in Canadian and US markets, it's quick to set up and allows easy access to your money. · Tax. Amount of money that you have available to invest initially. Step 2 Planning for the future starts right now! Free Financial Planning Tools. Invest in High-Quality Dividend Stocks. This is one of the most popular answers to the question of what to invest dollars in. This amount. Popular next steps. See what's out there. Best Roth IRA accounts. Browse the top brokerages to open a Roth IRA right now. lffinance.ru: How to Invest $$ 10e: The Small Investor's Step-by-Step Plan for Low-Risk Investing in Today's Economy: Dunnan. ETFs and other funds. Once you've paid off your credit card and put enough money away for emergencies and large future expenses, you're ready to start investing. Find helpful customer reviews and review ratings for How to Invest $$ The Small Investor's Step-By-Step, Dollar-By-Dollar Plan for Low Risk. We spoke to six experts about where they'd invest $1 million right now. Ideas include municipal bonds, European and Japanese equities, and dividend-paying US. Newsmax offers a unique investment opportunity: Shares of company stock with a 7% accrued dividend. Invest as little as $ in our private offering. Bloomberg News · The brutal reality of plunging office values is here. · The S&P recently hit 5, Should you buy now? · These countries are. You've probably heard that cash is king right now. But where can you stash your cash, earn a great rate, and avoid early withdrawal penalties if you want to. If you have checked the box to show values after inflation, this amount is the total value of your investment in today's dollars. You have a right to request. Index funds: This asset is a portfolio of stocks or bonds that tracks a market index. It tends to have lower expenses and fees when compared with actively. Best Ways to Invest $5, in Real Estate Today · Real Estate Crowdfunding · Partner with Seasoned Investors · Real Estate Investment Trusts (REITs) · Self-directed. (Note: Older EE bonds may be different from ones we sell today.) I Bonds. Protect against inflation. The interest rate on a particular I bond changes every 6.

Which Is Better Mt4 Or Mt5

Is MetaTrader 5 A Good Trading Platform? If we set MT4 vs. MT5, we notice that MT5 offers a better user interface, which improves its. However, there are some key differences between the two platforms. MT5 is a more powerful platform with better performance and support. However, it is also a. The new MT5 version is considered to be superior for stock trading and order management, while the older MT4 platform is considered to be superior for forex. Despite numerous updates, MetaTrader 5 has not matched the popularity of MT4, which is currently the most popular trading platform. Learn the difference between MetaTrader 4 (MT4), MetaTrader 5 (MT5), and OctaTrader. Find out which online trading platform is best for your trading style. MT5 does offer eight more indicators than MT4 as part of the default package. But as MT4's 30 standard indicators include the most popular types, the difference. The main difference between MT4 and MT5 is that MetaTrader 5 was developed to attract market brokers beyond Forex, while MetaTrader 4 remains today's dominant. MT4 offers a lot of customizability when it comes to charts. Users can add objects, indicators, colors, and alerts to create the best analysis, while MT5 offers. MT5 is for traders who want more features and better performance when making trades and analyzing data. In the end, it's all about what you need. Is MetaTrader 5 A Good Trading Platform? If we set MT4 vs. MT5, we notice that MT5 offers a better user interface, which improves its. However, there are some key differences between the two platforms. MT5 is a more powerful platform with better performance and support. However, it is also a. The new MT5 version is considered to be superior for stock trading and order management, while the older MT4 platform is considered to be superior for forex. Despite numerous updates, MetaTrader 5 has not matched the popularity of MT4, which is currently the most popular trading platform. Learn the difference between MetaTrader 4 (MT4), MetaTrader 5 (MT5), and OctaTrader. Find out which online trading platform is best for your trading style. MT5 does offer eight more indicators than MT4 as part of the default package. But as MT4's 30 standard indicators include the most popular types, the difference. The main difference between MT4 and MT5 is that MetaTrader 5 was developed to attract market brokers beyond Forex, while MetaTrader 4 remains today's dominant. MT4 offers a lot of customizability when it comes to charts. Users can add objects, indicators, colors, and alerts to create the best analysis, while MT5 offers. MT5 is for traders who want more features and better performance when making trades and analyzing data. In the end, it's all about what you need.

MT5 offers a much wider assortment of financial instruments compared to MetaTrader 4. Traders can operate not only in currency pairs, metals, and CFDs. Can I trade on my MetaTrader 4 account using a MetaTrader 5 platform? 6 main differences of MT4 and MT5 · 1. Supported assets: MT4: Primarily designed for forex trading and contracts for difference (CFDs). · 2. Order types: MT4. MT5 is faster than MT4. It doesn't slow down your platform. It is a fully fledged bit, multi-threaded platform, whilst MT4 is a bit. The little difference between MT4 and MT5 makes MT5 a stronger and more efficient software altogether. The new MT5 version is definitely more powerful and. If you are looking for a platform that can offer more symbols and markets, more order types, and partial fills, then Metatrader 5 could potentially be a better. MT5 is faster than MT4. It doesn't slow down your platform. It is a fully fledged bit, multi-threaded platform, whilst MT4 is a bit. If we set MT4 vs. MT5, we notice that MT5 offers a better user interface, which improves its overall user experience while offering more options to traders. 1. The MT5 platform offers 21 time frames, while MT4 offers only 9 time frames. The platform allows a trader to send 2 market orders, 6 pending orders, and 2 stop. MT4 is a more straightforward platform that is ideal for forex traders, while MT5 is a more versatile platform that is better suited for traders who want to. MT4 is the older platform.. it's definitely not as good MT however, as MT4 has a larger user base, there are more trading robots and tools. So while MT4 covers basics well, MT5 better equips manual and automated traders alike with more indicators, faster backtesting, superior. MT4 was built to allow trading Forex while MT5 offers trading on forex, futures, stocks and CFDs. The updated programming language on MT5 allows faster back. 1. MT5 Offers More Than Forex And CFDs. Your access to financial markets is much better with MT5 than with MT4. Both trading platforms are popular amongst Forex brokers. MT4 was built by Metaquotes, has been around for the longest and remains the most popular amongst. MT4 is the software platform of choice for forex-focused traders. MT5 is more widely used in contracts for Difference (CFD), equities and futures trading. MT4 was specifically built for forex traders, whereas MT5 was designed to provide traders with access to CFDs, stocks and futures. Conclusion · User interface: MT4 has a simpler interface that is easy to use, while MT5 has a more complex interface with more advanced trading tools. · Features. MT4's trading platform provides everything required to function as a Forex or CFD trader. MT5, on the other hand, presents a multi-asset trading platform. The MetaTrader 5 platform was developed five years later than the MT4 and has additional features that are not available to traders using the MT4. The MT5.

Which Bank Offers The Best Business Account

Best known for their high-reward credit cards, Chase Bank offers a variety of banking solutions, such as small business lending, and merchant services. Add in. PNC's basic Business Checking Account is a great option for a small or growing business. Avoid monthly fees and earn cash rewards. Apply online today! Best banks for small business at a glance ; NBKC: Best bank for small business for no fees. Chase Business Complete Banking · Bank of America Business Advantage Fundamentals Banking · Wells Fargo Initiate Business Checking Account · U.S. Bank Silver. Five Star Bank offers an assortment of Business Accounts from a TotalValue Business Checking Account to a NOW Business Account. We are here to support you. Best Small-Business Bank Account Promotions & Bonuses · Chase Business Complete Checking® – $ Bonus · U.S. Bank Business Checking — Up to $ Bonus · Axos. Chase Business Complete Banking℠. Chase has more than branches in the US, making it a great choice for business owners who want the convenience of bricks. Simplify your small business banking and help your company grow with Bank of America Business Advantage. Open a business bank account, find credit cards. There is no fees to have the account and no minimums and it pays % interest and their debit offers.5% cashback. For local, I use US Bank. Best known for their high-reward credit cards, Chase Bank offers a variety of banking solutions, such as small business lending, and merchant services. Add in. PNC's basic Business Checking Account is a great option for a small or growing business. Avoid monthly fees and earn cash rewards. Apply online today! Best banks for small business at a glance ; NBKC: Best bank for small business for no fees. Chase Business Complete Banking · Bank of America Business Advantage Fundamentals Banking · Wells Fargo Initiate Business Checking Account · U.S. Bank Silver. Five Star Bank offers an assortment of Business Accounts from a TotalValue Business Checking Account to a NOW Business Account. We are here to support you. Best Small-Business Bank Account Promotions & Bonuses · Chase Business Complete Checking® – $ Bonus · U.S. Bank Business Checking — Up to $ Bonus · Axos. Chase Business Complete Banking℠. Chase has more than branches in the US, making it a great choice for business owners who want the convenience of bricks. Simplify your small business banking and help your company grow with Bank of America Business Advantage. Open a business bank account, find credit cards. There is no fees to have the account and no minimums and it pays % interest and their debit offers.5% cashback. For local, I use US Bank.

For the ambitious business owner seeking a stable foundation, Initiate Business Checking gives you digital tools and support you can count on. It's designed for. Extras – Well Fargo offers three types of business checking accounts plus add-on services in areas like payroll and taxes. How to choose the best small business. Bank of America is a great choice for new small local businesses that want in-person support. It stands out from other traditional banks with its built-in tools. CSI is an affiliate of Citizens Bank, N.A. Please be aware that the securities products offered are different from those offered by a bank and are subject to. Explore business checking accounts and choose the solution that's right for your business. Business Advantage checking accounts are designed to move your. The best business bank accounts and treasury management tools for your business It provides a comprehensive checking account that is ideal for. Bank of America Business Advantage Fundamentals Banking Bank of America is a large and well-known bank with wide access across the country. It does come with. The main reason to go with Bank of America is convenience as BofA doesn't really offer anything unique compared with other business checking accounts. However. Get free Overdraft Protection with a linked Capital One Business deposit account. 70,+ No-Fee ATMs. Access. Explore Our Best Business Bank Accounts and Services ; Basic Business Checking. No monthly maintenance fees. Free domestic incoming wires. Explore Checking. Chase for Business provides business bank account offers applicable to merchant services, business credit cards, and business checking accounts. How did we choose these business checking accounts? · #1: Chase Business Complete Banking · #2: Bank of America Business Advantage Fundamentals · #3: Digital. The Grasshopper Innovator Business Checking Account offers the highest APY of any institution on our list, making it a good choice for anyone looking to earn. Ideal for tech-savvy sole proprietors that prefer online banking, Bluevine offers a business checking account that earns 2% interest on balances of up to. Banking with Bluevine can help your small business grow. Its checking account and additional features are flexible, quick, and easy to use. Bluevine also offers. Chase and Bank of America are arguably the best choice for a small business. They both are considered too big too fail, offer new account. Business accounts you need to succeed ; Silver Business Checking Package. Best for new or small businesses with basic banking needs. $0 monthly maintenance fee. Unlock faster global payments, industry-leading yield, and 20x FDIC protection from day 1. This is business banking, made better. Open an account in Best Business Accounts for Small Business · 1. Wise Business · 2. Lili Business Checking · 3. Chase Business Complete Banking℠ · 4. NBKC Business Account · 5. Found. If you are looking for the best business bank accounts that offer unlimited transactions then look no further than Capital One business accounts. The bank has a.

S And P 500 Historical Chart

Backtest by Curvo is the best backtesting simulator for European index investors. Discover the historical performance of your portfolio and compare it to. Historical Returns on Stocks, Bonds and Bills: Data Used: Multiple data services. Data: Historical Returns for the US S&P (includes dividends). Discover real-time S&P (SPX) share prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Historical stock closing prices for S&P Index (SP). See each day's opening price, high, low, close, volume, and change %. Historical stock closing prices for S&P Index (SP). See each day's opening price, high, low, close, volume, and change %. Downloads. Download the S&P historical returns in CSV or JSON format. S&P Data. S&P Historical Returns. S&P Index | historical charts for SPX to see performance over time with comparisons to other stock exchanges. Cumulative returns are calculated by Guggenheim Investments. Logarithmic graph of the S&P ® Index from through Bull and bear markets. View data of the S&P , an index of the stocks of leading companies in the US economy, which provides a gauge of the U.S. equity market. Backtest by Curvo is the best backtesting simulator for European index investors. Discover the historical performance of your portfolio and compare it to. Historical Returns on Stocks, Bonds and Bills: Data Used: Multiple data services. Data: Historical Returns for the US S&P (includes dividends). Discover real-time S&P (SPX) share prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Historical stock closing prices for S&P Index (SP). See each day's opening price, high, low, close, volume, and change %. Historical stock closing prices for S&P Index (SP). See each day's opening price, high, low, close, volume, and change %. Downloads. Download the S&P historical returns in CSV or JSON format. S&P Data. S&P Historical Returns. S&P Index | historical charts for SPX to see performance over time with comparisons to other stock exchanges. Cumulative returns are calculated by Guggenheim Investments. Logarithmic graph of the S&P ® Index from through Bull and bear markets. View data of the S&P , an index of the stocks of leading companies in the US economy, which provides a gauge of the U.S. equity market.

lffinance.ru: Stock market poster S&P | historical stock chart Black (36x24 Inch): Posters & Prints. The S&P ® is widely regarded as the best single gauge of large-cap U.S. equities. The index includes leading companies and covers approximately 80%. lffinance.ru: Stock market poster S&P | historical stock chart White (36x24 Inch): Posters & Prints. Get S&P Index live stock quotes as well as charts, technical analysis, components and more SPX index data. Get free historical data for SPX. You'll find the closing price, open, high, low, change and %change for the selected range of dates. The data can be viewed in. Dieses Aktienposter mit historischem Aktienchart zeigt den S&P seit inklusive historische Ereignisse. Graph and download economic data for S&P from to FRED and its associated services will include 10 years of daily history for Standard &. United States Stock Market Index (US)Index Price | Live Quote | Historical Chart ; S&P Global. ; Walt Disney. ; Pfizer. ; Morgan Stanley. S\&P index data including level, dividend, earnings and P/E ratio on a monthly basis since The S\&P (Standard and Poor's ) is a free-float. Get historical data for the S&P (^GSPC) on Yahoo Finance. View and download daily, weekly or monthly data to help your investment decisions. Find the latest S&P (^GSPC) stock quote, history, news and other vital information to help you with your stock trading and investing. View live S&P Index chart to track latest price changes. SP:SPX trade ideas, forecasts and market news are at your disposal as well. Download S&P Index stock data: historical SPX stock prices from MarketWatch. S&P data as of July 18, Source: Macrotrends and Federal Reserve Bank of St. Louis Get the. This interactive chart tracks the ratio of the S&P market index to the price of gold. The number tells you how many ounces of gold it would take to buy. S&P Historical Prices table by year, historic, and current data. Current S&P Historical Prices is , a change of from previous market. The above graph shows a 30 year historical of the S&P The stock market is on its 11 year of a bull market. When markets are high many investors DO NOT feel. United States - S&P was Index in September of , according to the United States Federal Reserve. Historically, United States - S&P SPX | A complete S&P Index index overview by MarketWatch. View stock market news, stock market data and trading information. Historical Data of S&P Index From to